Bubble Economy

Book By Christopher Wood

Article & Review by GlobalMacroForex

|

|

This book was

written in 1992 just as the Japanese economic bubble was starting to

burst.� It�s amazing that Christopher

Wood�s predictions were so accurate and (unfortunately) true.� The extent of the bubble�s rise and the

following correction (20+ years of misery, nicknamed the �lost decades� )

truly were misunderstood by the market at the time.� This is the Nikkei

225, the most prominent Japanese stock index.

|

||

|

|||

Central Bank Policy

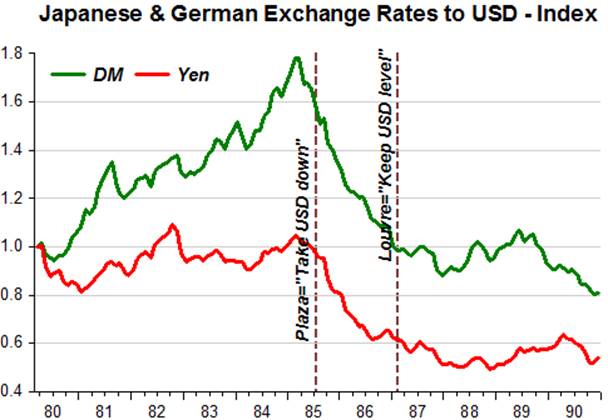

Woods criticizes the insane policies of the Bank

of Japan.� The Ministry of Finance

appointed Satoshi Sumita to head the Central Bank who negotiated the 1985 Plaza

Accord.� This agreement was made in

America, with the goal of lowering the USD/JPY exchange rate.� By artificially propping up the yen, it

fueled an investment bubble in property and equity shares.�

Yasushi Mieno then took over as head of the Bank

of Japan.� He hated the easy credit

policies of his predecessor and hiked rates, which was just enough to pop the

huge bubble.

Main Bank System

One of the primary causes of the crisis in the

view of Christopher Woods is the overreliance on bank credit.� Unlike America, which has a liquid and deep

bond market, Japan essentially exclusively relied on bank credit.� To make matters worse, the banks held shares

of equities, making their capital positions very depend on market

conditions.� Banks collectively owned 9%

of the entire Tokyo stock exchange�s market capitalization in 1990.

�This

is the fatal flaw of Japan�s financial system.�

The capital of the world�s biggest banks, and therefore, their ability

to lend, goes up and down with the short-term whims of the Tokyo stock market.�

Woods points out how when the Bank of

International Settlements (BIS) started to force Japanese banks to comply with

higher equity to liability ratios, some banks sold stocks and then rebought

them to book the gain as equity capital increases.�� This trick obviously only works in a rising

market and disastrously caused selling when these banks� loans turned

sour.� Once the asset prices fell, it

took banks nearly 20 years to start loaning again.

In addition, Woods questions Japan�s laws and

cultural stigma on bankruptcy.

�Bouncing a check is commercial suicide in

Japan�

He

points out the Japanese culture of assuming ever larger market share but being

unwilling to admit failure due to the large stigma attached, combined with

loose laws from the BIS and local regulators, created a climate where banks had

many loans on their books that were really nonperforming/delinquent but weren�t

being classified as such.

Under

the Japanese main banking system, the biggest lender in a bankruptcy assumes

the debts of nearly all other creditors.�

This leads to a situation where the largest main banks are not only

being less willing to recognize loan losses, but also even further

leveraged.� With this massive leverage, a

small number of sour loans can topple banking giants.

Land Boom

Japan had a ridiculous bubble in land prices.� At the end of 1989, Japan�s combined real

estate had a market value of 4 times the entire US market.

�While

other countries previously had currencies backed by gold.� It is not unrealistic to say Japan is a land

standard.�

The average size of a bank home mortgage had

exploded from �5.6 million to �11 million in 1990.� The decline in prices to �back-to- earth�

levels was quite painful over 20 years as this graph from RightWayCharts shows,

Banks were fueling this run-up in the land.� There were bank loans of 66 trillion yen in

March 1991, two-fifths of which went directly to property and construction

companies.� And two-thirds was

collateralized with land.� Banks were all

too willing to extend loans guaranteed and collateralized with land because the

prices were rising quickly.� Once land

prices started to crash and loans went sour, banks were stuck with depreciating

assets, causing them to be forced to liquidate shares.� This further exacerbated the crash since the

banks owned such a huge percentage of the equity market.

Interbank Euromoney Borrowing

�Euromoney� is a term used to refer to bank

deposits outside of the nation that issues the currency.� The name originates from American dollars

being loaned around Europe.� Used in this

sense, it doesn�t mean the actual Euro currency.

Japanese banks were borrowing Euroyen and

Eurodollars to fund a whole variety of loans, including not only the domestic

Japanese real estate loans but loans on property abroad as well.� These short-term interbank loans need to constantly

be rolled over and so are subject to extreme interest rate shocks when the

markets turns to a risk-off environment.�

In addition, the eurocurrency markets are even more risk-prone than

onshore interbank lending to credit shocks because onshore regulators guarantee

bank deposits.� Unlike the eurocurrency

bank market which would need to set up foreign currency swaps to get the

liquidity in a credit crunch.

The Japanese went on an overseas real estate lending

binge with these cheap Euromoney interbank loans.� In 1991, 12.4% of total American banking

assets, valued at $408 billion, was owned by Japanese banks. In addition, there

was a heavy concentration of loans made on property in California.� 24.5% of total bank assets in California by

June 1991 was owned by the Japanese banks.�

Unloading all these foreign assets when interbank lending dried up was a

serious challenge.

Life Insurance Companies

Life insurance companies owned 13% of the

companies traded on the Tokyo stock market at end of 1990.� As Japanese policyholders cashed in life

insurance policies this caused massive selling of equities.� Life insurance companies are supposed to be

stable and reliable vehicles to protect one�s family should horrible

circumstances come to fruition.� Many

Japanese households were not aware they were really speculative hedge funds;

gambling away their savings on the stock exchange.

Life insurances companies had no choice but to

sell to meet their debt/payout obligations.�

These concentrated holdings represented a �fair weather friend� to banks

whom they frequently had cross shareholder holdings with.� (The bank would buy shares of the life

insurance company and vice versa.)

Golf Club Memberships

|

|

Between 1989 and 1991, 160 new golf courses were

created with 2000 more under construction.�

For a tiny archipelago, the prices of these memberships were

soaring.� The memberships were being

traded like securities in a nation that perpetuated the myth that 99% of the

population was middle class.� This

chart from The Economist magazine shows the price of these memberships after

the bubble burst,

|

Conclusion

The main lessons to be drawn from the Japanese

bubble are the dangers in allowing central banks to grant easy money and the

business community's over-reliance on bank credit.� Central banks shouldn�t always be handing out

what bankers want.

Also, there is a need to diversify the types of

assets being securitized for bank loans as these assets will all fall uniformly

in value.� Similar to the United States

real estate bubble, there is a huge error in thinking that just because an

asset has always risen in value in the past, that it will always continue to

rise.